SCENARIO 5-1 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-1

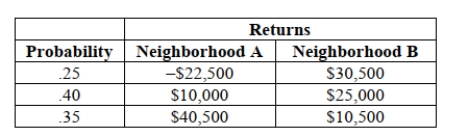

There are two houses with almost identical characteristics available for investment in two different

neighborhoods with drastically different demographic composition.The anticipated gain in value

when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-1, if your investment preference is to minimize the amount of risk that

you have to take and do not care at all about the expected return, will you choose a portfolio that

will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A

and the remaining on the house in neighborhood B?

Definitions:

Oligopoly Behavior

Strategic actions by firms in a market where a few dominant firms interact, leading to solutions and outcomes that depend on the choices of the other market participants.

Prisoner's Dilemma

The Prisoner's Dilemma is a standard example of a game analyzed in game theory that shows why two completely rational individuals might not cooperate, even if it appears that it is in their best interest to do so.

Collude

When two or more parties come together to limit open competition by deceiving or misleading others about their rights and obligations.

Uncertain

Lacking predictability, assurance, or clarity about outcomes or consequences.

Q2: True or False: A population parameter is

Q5: True or False: Referring to Scenario 8-8,

Q23: If a researcher rejects a false null

Q26: The portfolio expected return of two investments<br>A)

Q41: True or False: Referring to Scenario 8-7,

Q70: True or False: Referring to Scenario 8-7,

Q86: Referring to Scenario 10-6, what is the

Q88: True or False: When you work with

Q90: If a researcher does not reject a

Q100: Referring to Scenario 4-9, if a randomly