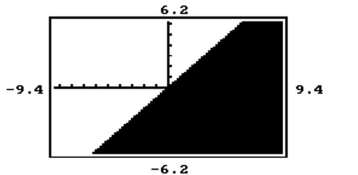

Determine the inequality which matches the calculator graph. Do not use your calculator. Instead, use your knowledge

of the concepts involved in graphing inequalities.

-

Definitions:

Ending Inventory

At the close of an accounting period, the value of products available for sale is calculated by taking the initial inventory, adding any purchases, and then deducting the cost of goods sold.

Cost Flow Assumption

An accounting method that determines the cost of goods sold and ending inventory valuation, examples include FIFO, LIFO, and weighted average.

LIFO

Last In, First Out, is an inventory valuation method assuming that goods purchased last are the first to be sold.

FIFO

First In, First Out, a method used in accounting to manage inventory and financial matters where the first items placed in inventory are the first sold or used.

Q71: Let <span class="ql-formula" data-value="M"><span class="katex"><span

Q153: The solid line L contains the point

Q174: <span class="ql-formula" data-value="\left| \begin{array} { r r

Q186: 8x + 7y = 4 A)

Q194: <span class="ql-formula" data-value="\left[ \begin{array} { r r

Q301: Find the dimensions of a rectangular

Q414: <span class="ql-formula" data-value="\left[ \begin{array} { l l

Q444: <span class="ql-formula" data-value="\begin{array} { r } -

Q445: <span class="ql-formula" data-value="\left[ \begin{array} { l l

Q446: <span class="ql-formula" data-value="( - i ) ^