Solve the problem.

-Use the formula

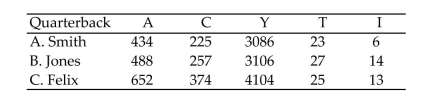

Passing Rating , where number of passes attempted, number of passes completed, total number of yards gained passing, number of touchdown passes, and = number of interceptions, to approximate the passing rating for . Felix. Round to the nearest tenth.

Definitions:

FICA Tax

The Federal Insurance Contributions Act (FICA) tax is a payroll tax in the United States that is required from both employers and employees to support Social Security and Medicare programs.

Federal Income Tax

A tax levied by the federal government on an individual's or corporation's annual income.

Withholding Allowance

A provision allowing employees to reduce the amount of income tax withheld from their paycheck, based on their personal allowances and deductions.

Gross Earnings

Total income earned by an individual or entity before any deductions or taxes.

Q4: <span class="ql-formula" data-value="- 7 ^ { -

Q41: <span class="ql-formula" data-value="| - 2 x +

Q87: <span class="ql-formula" data-value="- 11 x ^ {

Q123: <span class="ql-formula" data-value="\frac { \sqrt [ 3

Q164: <span class="ql-formula" data-value="\frac { x } {

Q221: <span class="ql-formula" data-value="\left( 2 x + \frac

Q282: <span class="ql-formula" data-value="5 x ^ { -

Q292: To solve for the lengths of

Q325: <span class="ql-formula" data-value="( n - 1 )

Q327: <span class="ql-formula" data-value="2 x ^ { 2