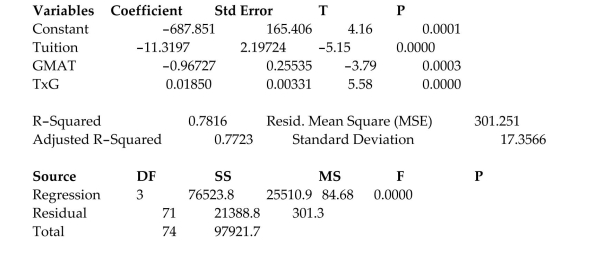

A study of the top MBA programs attempted to predict the average starting salary (in $1000ʹs) of graduates of the program based on the amount of tuition (in $1000ʹs) charged by the program and

The average GMAT score of the programʹs students. The results of a regression analysis based on a

Sample of 75 MBA programs is shown below: Least Squares Linear Regression of Salary

Predictor

Cases Included Missing Cases 0

The global- test statistic is shown on the printout to be the value . Interpret this value.

Definitions:

Rational Risk-averse Investor

An investor who prioritizes minimizing risk over achieving potentially higher returns when making investment decisions, acting based on logical analysis.

Well-diversified Portfolio

A Well-diversified Portfolio is an investment strategy that involves spreading investments across various asset classes and sectors to reduce risk while improving potential returns.

Diversification

An investment strategy aimed at reducing risk by allocating investments among various financial instruments, industries, and other categories.

Economic Uncertainty

Situations where the future economic conditions or financial market trends cannot be predicted with certainty.

Q24: A sports researcher is interested in

Q25: The process for finding a percentile is

Q30: A study of the top MBA

Q33: Farr Company reported the following on

Q50: Probabilistic models are commonly used to estimate

Q51: An adverse drug effect (ADE)is an

Q73: A breeder of Thoroughbred horses wishes

Q102: A collector of grandfather clocks believes

Q108: Which equation represents a complete second-order

Q164: Your teacher announces that the scores on