A public health researcher wants to use regression to predict the sun safety knowledge of pre-school children. The researcher randomly sampled 35 preschoolers, assigned them to one of

Two groups, and then measured the following three variables: SUNSCORE: Score on sun-safety comprehension test

READING: Reading comprehension score

GROUP: if child received a Be Sun Safe demonstration, 0 if not

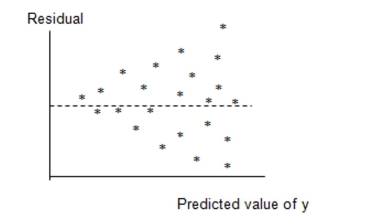

A regression model was fit and the following residual plot was observed.

Which of the following assumptions appears violated based on this plot?

Definitions:

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since the asset was acquired.

Gain on Sale

The income generated when an asset is sold at a value higher than its original cost or book value.

Machinery

Heavy and complex machines or equipment used in various industries for manufacturing, construction, or specific tasks requiring mechanical force.

Book Value

The value of an asset as recorded on the balance sheet, calculated by subtracting any associated depreciation or amortization from its original cost.

Q1: Waters Department Store had net credit sales

Q6: The ages and systolic blood pressures

Q23: Is there a relationship between the

Q27: Specify the rejection region for the

Q35: Parking at a large university has become

Q36: Indicate where the event purchased land for

Q76: A horizontal analysis performed on a statement

Q113: Short-term creditors are usually most interested in

Q185: The scatterplot below shows a negative relationship

Q192: There are 10 players in a