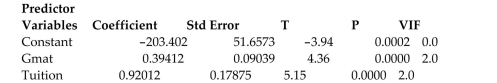

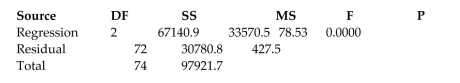

A study of the top MBA programs attempted to predict the average starting salary (in $1000ʹs) of graduates of the program based on the amount of tuition (in $1000ʹs) charged by the program and

The average GMAT score of the programʹs students. The results of a regression analysis based on a

Sample of 75 MBA programs is shown below: Least Squares Linear Regression of Salary

Interpret the coefficient of determination value shown in the printout.

Definitions:

Systematic Risk

The risk inherent to the entire market or market segment, also known as non-diversifiable risk or market risk.

Market Risk Premium

The higher return an investor foresees from investing in a market portfolio with associated risks as opposed to choosing completely safe assets.

Risky Asset

An asset that carries a higher degree of risk of loss, but also offers a higher potential return.

Risk-free Asset

An investment with zero risk of financial loss, theoretically providing guaranteed returns, such as government bonds.

Q1: The scores for a statistics test

Q5: A certain type of rare gem

Q8: For the situation above, give a

Q40: Is the number of games won

Q42: The dean of the Business School

Q49: A high value of the correlation coefficient

Q50: The randomized block design is an extension

Q60: A survey of entrepreneurs focused on

Q71: For any events A and B,

Q124: A statistics professor gave three quizzes