Operations managers often use work sampling to estimate how much time workers spend on each operation. Work sampling-which involves observing workers at random points in time-was

Applied to the staff of the catalog sales department of a clothing manufacturer. The department

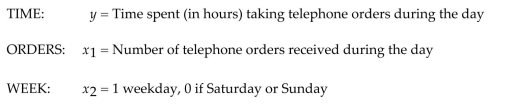

Applied regression to the following data collected for 40 consecutive working days:

Consider the following 2 models:

Model 1:

Model 2:

What strategy should you employ to decide which of the two models, the higher-order model or the simple linear model, is better?

Definitions:

Promissory Note

A financial instrument containing a written promise by one party to pay another a definite sum of money either on demand or at a specified future date.

Negotiable

Capable of being transferred or assigned from one party to another, often used in the context of financial instruments.

Nonexistent Person

A fictional or imagined individual who does not exist in reality.

Negotiable

Capable of being transferred or converted into goods, services, or money under terms agreeable to all parties involved.

Q11: A fan observes the numbers on the

Q33: Farr Company reported the following on

Q56: To investigate the relationship between yield

Q59: A company has an average inventory

Q64: The goal of an experiment is

Q80: Gold Clothing Store had a balance in

Q82: Consider the interaction model <span

Q86: In horizontal analysis, if an item has

Q107: Which one of the following is primarily

Q131: Which of the following transactions does not