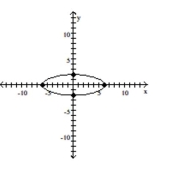

Identify the intercepts.

-

Definitions:

WACC

Weighted Average Cost of Capital is an evaluation method for determining the cost of a company's capital, with each source of capital weighted based on its relative proportion.

Present Value

Present value is the current worth of a future sum of money or stream of cash flows, given a specified rate of return.

Regular IRR

The Internal Rate of Return (IRR) is a financial metric used to estimate the profitability of potential investments.

WACC

The Weighted Average Cost of Capital represents the average cost of a company's financing (debt and equity), where each form of capital is weighted according to its proportion in the overall financing mix.

Q40: Use the revenue and cost functions

Q73: The table shows the average hourly

Q90: Two numbers have a sum of 119

Q126: <span class="ql-formula" data-value="\frac { \mathrm { d

Q135: A quadrilateral is a four-sided figure

Q139: <span class="ql-formula" data-value="1.13 \times 10 ^ {

Q156: <span class="ql-formula" data-value="( 3 z + 10

Q230: <span class="ql-formula" data-value="x = 3"><span class="katex"><span class="katex-mathml"><math

Q261: <span class="ql-formula" data-value="( w - y )

Q292: Center City East Parking Garage has a