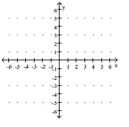

Graph the linear equation.

-

Definitions:

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specified time.

Black-Scholes

A mathematical model used to estimate the theoretical price of European put and call options, considering factors such as risk-free rate, volatility, and time.

Instantaneous Risk-free Rate

The theoretical rate of return of an investment with no risk of financial loss, typically considered as a very short-term government bond yield.

Hedge Ratio

The ratio of the size of a position in a hedging instrument to the size of the position being hedged.

Q7: 4n - 3n + 6 = 6<br>A)

Q21: <span class="ql-formula" data-value="8 x + x -

Q104: <span class="ql-formula" data-value="P = a + b

Q111: <span class="ql-formula" data-value="( - \infty , 2

Q117: <span class="ql-formula" data-value="\frac { x ^ {

Q155: <span class="ql-formula" data-value="P ( x ) =

Q235: <span class="ql-formula" data-value="2 y = x -

Q237: <span class="ql-formula" data-value="- x + 8 y

Q238: <span class="ql-formula" data-value="y = \frac { 5

Q296: Through <span class="ql-formula" data-value="( 8