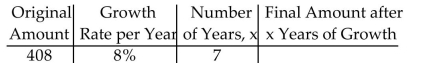

Use the exponential growth formula to find the final amount. Round to the nearest whole.

-

Definitions:

Interperiod Tax Allocation

The method of accounting that recognizes the tax effect of differences between the timing of income recognition for financial reporting and tax purposes.

Investment Income

The money earned from various types of investments, including stocks, bonds, mutual funds, and real estate.

Municipal Bonds

Bonds issued by local, state, or county governments to finance public projects, typically offering tax-exempt interest payments.

Deferred Income Taxes

Tax liabilities that arise due to timing differences between the recognition of income and expenses in the financial statements and their recognition in the tax returns, deferred to future periods.

Q14: <span class="ql-formula" data-value="\log _ { 5 }

Q68: <span class="ql-formula" data-value="96,24,6 , \cdots"><span class="katex"><span class="katex-mathml"><math

Q71: If <span class="ql-formula" data-value="a _

Q120: S <span class="ql-formula" data-value="_ { 20

Q128: <span class="ql-formula" data-value="\frac { x } {

Q144: The --------, written n!, is the product

Q148: <span class="ql-formula" data-value="f(x)=-4(x+2)^{2}-5"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mi>f</mi><mo stretchy="false">(</mo><mi>x</mi><mo

Q159: <span class="ql-formula" data-value="\log 4.60"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mi>log</mi><mo></mo><mn>4.60</mn></mrow><annotation

Q215: <span class="ql-formula" data-value="f = \{ ( -

Q315: <span class="ql-formula" data-value="\sqrt [ 5 ] {