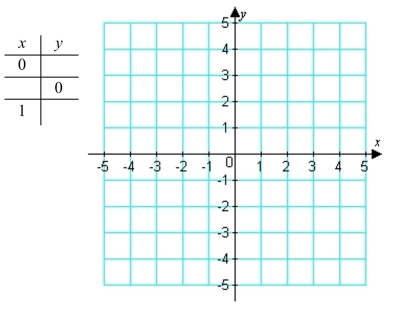

Complete the table. Then graph the line defined by the points.

Definitions:

Call Options

Call options are financial contracts that give the option buyer the right, but not the obligation, to buy a specified quantity of an asset at a predetermined price within a set time frame.

Risk-Free Rate

The theoretical rate of return of an investment with zero risk, typically represented by the yield on government securities such as Treasury bills.

Striking Price

The predetermined price at which the holder of an option contract can buy (call) or sell (put) the underlying asset.

Callable Bonds

Callable bonds are bonds that can be redeemed by the issuer prior to their maturity date at a specified call price.

Q1: Fill in the blank to make

Q5: Find the nth term of the

Q7: Write the relation as a set of

Q65: Find the x-intercept and the y-intercept

Q65: Factor the trinomial completely by using

Q72: A medical researcher is interested in

Q72: Identify the line as either vertical

Q88: Evaluate the rational function, if possible.

Q106: Solve for the indicated variable.

Q135: Find the perimeter. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7603/.jpg" alt="