Definitions:

Employee Participation Programs

Initiatives that involve employees in decision-making processes, typically to increase engagement, satisfaction, and productivity.

Profit-sharing

A company policy of distributing a portion of its profits to its employees.

Job Security

The probability that an individual will keep their job; a secure job is one where there is little risk of becoming unemployed.

Intrinsic

Relating to the fundamental nature or inherent qualities of something, often implying an internal motivation or value.

Q4: A bond analyst is analyzing the

Q10: Find the variance for the values

Q13: What is the median of the following

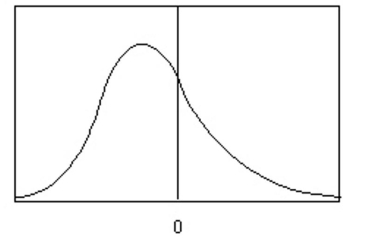

Q21: Determine whether the alternative hypothesis is

Q25: The following display from a TI-84

Q47: The average length of crocodiles in a

Q53: According to a study of 90 truckers,

Q81: Which of the following properties distinguishes the

Q86: The critical value for a two-tailed

Q87: If the test value for the