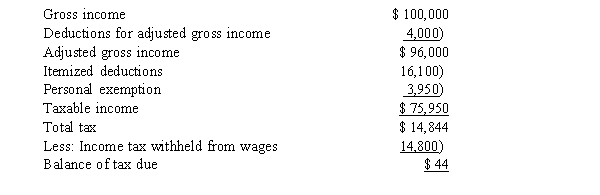

Sally is a single individual. In 2014, she receives $10,000 of tax-exempt income in addition to her salary and other investment income of $100,000. Sally's 2014 tax return showed the following information:  Which of the following statements concerning Sally's tax rates is are) correct? I. Sally's average tax rate is 19.5%. II. Sally's average tax rate is 25.0%. III. Sally's marginal tax rate is 25%. IV. Sally's marginal tax rate is 28%.

Which of the following statements concerning Sally's tax rates is are) correct? I. Sally's average tax rate is 19.5%. II. Sally's average tax rate is 25.0%. III. Sally's marginal tax rate is 25%. IV. Sally's marginal tax rate is 28%.

Definitions:

Create A New Blank Database

The process of initiating a new database that contains no data or structure, allowing the user to start from scratch in building tables, queries, forms, etc.

Import An Existing Database

The process of bringing data from one database into another, enabling the integration or analysis of information from different sources.

Open An Existing Database

The action of accessing a database file that has already been created and stored on a storage medium.

Create A Database From A Template

The process of establishing a new database by using a pre-designed structure and format provided as a template.

Q3: If a student is interested in determining

Q20: The chi-square independence test can be used

Q32: Roseanne sells her personal automobile for $1,000.

Q37: Given that a contingency table has

Q45: John sells his uncle Bob land held

Q51: Give the boundaries of the given value.

Q55: Bonnie's sister, Diane, wants to open a

Q66: A Two-Way ANOVA Summary Table is

Q69: The two types of tests that use

Q118: Monica's Lawn Service, Inc., purchases a heavy-duty