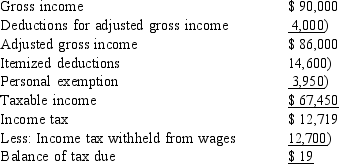

Betty is a single individual. In 2014, she receives $5,000 of tax-exempt income in addition to her salary and other investment income. Betty's 2014 tax return showed the following information:  Which of the following statements concerning Betty's tax rates is are) correct? I. Betty's average tax rate is 18.9%. II. Betty's average tax rate is 17.6%. III. Betty's effective tax rate is 18.9%. IV. Betty's effective tax rate is 17.6%.

Which of the following statements concerning Betty's tax rates is are) correct? I. Betty's average tax rate is 18.9%. II. Betty's average tax rate is 17.6%. III. Betty's effective tax rate is 18.9%. IV. Betty's effective tax rate is 17.6%.

Definitions:

Kinetic Family Drawing

The Kinetic Family Drawing is a projective psychological test used to understand children's perceptions of their family dynamics and relationships by asking them to draw their family doing something.

Cross-cultural

Pertaining to or comparing two or more cultures, examining their differences and similarities.

Draw-A-Woman

A projective psychological test used to evaluate children's intellectual maturity and emotional well-being based on their drawings of a woman.

Projective Personality

A type of personality test in which individuals respond to ambiguous stimuli, revealing hidden emotions, desires, and conflicts.

Q1: When Rick found out that Ryan's liabilities

Q15: An experiment is conducted to study

Q28: All deductions are allowed because of the

Q43: The Wilcoxon rank sum test is used

Q43: Which of the following is a Pareto

Q48: Each value in a data set may

Q60: If there is no difference in the

Q76: Which of the following is the best

Q83: The cash method of accounting for income

Q120: Which of the following always generate taxable