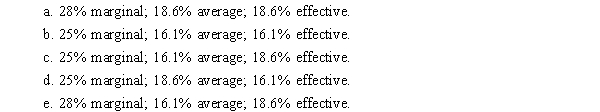

Katarina, a single taxpayer, has total income from all sources of $100,000 for 2014. Her taxable income after taking into consideration $25,000 in deductions and $10,000 in exclusions is $65,000. Katarina's tax liability is $12,106. What are Katarina's marginal, average, and effective tax rates?

Definitions:

Equipment Modifications

Changes or upgrades made to machinery or equipment to improve performance or efficiency.

Expansion Project

A business initiative aimed at increasing the scale of its operations, typically through new product lines or geographic markets.

Top-down Approach

Investment strategy that starts with global outlook and macroeconomic analysis before analyzing specific sectors and companies.

Operating Cash Flow

A measure of the amount of cash generated by a company's normal business operations.

Q34: Which of the following is not an

Q39: For each tax treatment described below, indicate

Q43: Steve is an employee of Giant Valley

Q51: An assumption for the goodness-of-fit test is

Q51: A researcher can use the Scheffé

Q58: Sandra sells a business-use warehouse to her

Q59: Bonita's employer has a nondiscriminatory childcare reimbursement

Q60: If there is no difference in the

Q62: Rae is a retired corporate executive. He

Q116: Glenn and Vera divorce during the current