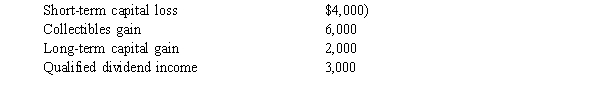

Shasta has the following capital gains and losses and Qualified dividend income during the current year:  If Shasta's marginal tax rate is 33%, what is the effect of the above on her taxable income and income tax liability? Income Tax Liability

If Shasta's marginal tax rate is 33%, what is the effect of the above on her taxable income and income tax liability? Income Tax Liability

Definitions:

EBITDA

Term for earnings before interest, taxes, depreciation, and amortization; operating income expressed by adding back depreciation and amortization expense.

Operating Income

The profit realized from a business's operations after deducting operating expenses from gross profit.

Income Tax

A tax levied by governments on individuals or entities based on their income or profits.

Selling Price

The price at which an item or service is offered to buyers.

Q9: Frank and Lilly are negotiating a divorce

Q10: The range of the correlation coefficient is

Q23: Tyrone sells his personal-use car that had

Q49: Any income earned subsequent to the death

Q67: A state sales tax levied on all

Q68: Draw a scatter plot for the

Q68: Which of the following expenses is/are deductible?

Q71: Marianne's uncle Mike gives her $20,000 of

Q102: Paul owns a lumber yard in Portland.

Q116: Victor receives a $4,000 per year scholarship