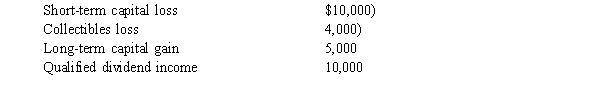

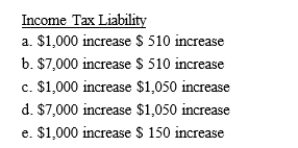

Angelica has the following capital gains and losses during the current year:  If Angelica's marginal tax rate is 33%, what is the effect of the above transactions on her taxable income and income tax liability?

If Angelica's marginal tax rate is 33%, what is the effect of the above transactions on her taxable income and income tax liability?

Definitions:

Cash Outflow

Pertains to the movement of money out of a business, primarily through expenses, payments to creditors, or investments, leading to a decrease in cash balance.

Financing Activity

Involves transactions related to a business's funding, including obtaining or repaying capital, issuing shares, and paying dividends.

Investing Activities

Financial transactions related to the purchase and selling of long-term assets and other investments not considered as cash equivalents.

Long-term Assets

Assets that are expected to provide economic benefits over periods longer than one year, such as buildings, machinery, and land.

Q7: Which of the following correctly describes the

Q10: One advantage of a(n) _ study is

Q20: The prediction interval around <span

Q40: Nelson is the owner of an apartment

Q48: Thomas changes jobs during the year and

Q54: Richard, a cash basis taxpayer, is an

Q58: Which of the following must be classified

Q103: Kristine is the controller of Evans Company.

Q104: Systech offered its stockholders a choice between

Q121: Which of the following tax rates applies