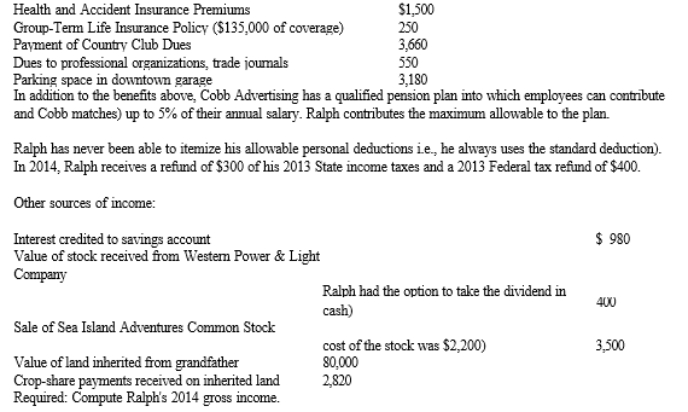

Summary Problem: Ralph, age 44, is an account executive for Cobb Advertising, Inc. Ralph's annual salary is $90,000. Other benefits paid by Cobb Advertising were:

Definitions:

Estimated Payments

Periodic payments on expected taxes for the current year, typically paid quarterly by self-employed individuals and others with income not subject to withholding.

$1,250

A specific monetary amount, possibly denoting a threshold, tax credit value, or an investment minimum.

Qualifying Widow(er)

A tax filing status allowing a surviving spouse to use joint tax rates for up to two years after the spouse's death, under certain conditions.

Taxpayer Remarry

When a taxpayer remarries, it changes their tax filing status and can affect determinations for deductions, credits, and tax liability.

Q7: To be away overnight requires the taxpayer

Q18: The allowance of deductions in calculating taxable

Q37: Willis is a cash basis taxpayer who

Q43: Julie travels to Mobile to meet with

Q59: How much additional Social Security tax does

Q63: Which of the following statement is/are included

Q105: Jered and Samantha are married. Their 2014

Q112: Lee's 2014 taxable income is $88,000 before

Q118: To be deductible, the dominant motive for

Q125: For the past seven years Karen, an