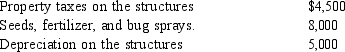

Virginia, a practicing CPA, receives $11,000 from the sale of rare orchids that she grows. Her expenses of operating this hobby activity follow:  How much of the expenses that Virginia incurs can be deducted as hobby expenses?

How much of the expenses that Virginia incurs can be deducted as hobby expenses?

Definitions:

Tax Rate Schedules

These are charts provided by the IRS that determine the amount of tax to be paid by individuals, corporations, and other entities based on their income level.

Tax Tables

Charts provided by the IRS to help taxpayers determine how much income tax they owe based on their income level and filing status.

Tax Rate Structure

The specific system or method of imposing taxes at different rates on different levels of income or types of transactions.

Revenue Rulings

Official interpretations of tax laws issued by the Internal Revenue Service that guide taxpayers in compliance.

Q22: Howard is single and has a son

Q24: Sullivan, a pilot for Northern Airlines, has

Q41: Kenneth owns all of the stock of

Q43: Julie travels to Mobile to meet with

Q51: Concerning individual retirement accounts IRAs), I. A

Q53: Rachel paid $1,000 for supplies in 2013.

Q71: Kim owns a truck that cost $35,000

Q97: Three years ago Edna loaned Carol $80,000

Q117: Sally is a corporate sales representative for

Q118: Eloise is a sales representative for a