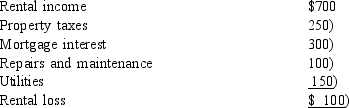

Mike and Pam own a cabin near Teluride, Colorado. In the current year the cabin was rented for 8 days to friends. Mike and Pam used the cabin a total of 82 days during the same year. After allocating the expenses between personal and rental use, the following rental loss was determined:  How should Mike and Pam report the rental income and expenses for last year?

How should Mike and Pam report the rental income and expenses for last year?

Definitions:

Plan Of Action

A detailed strategy outlining the steps needed to accomplish a specific goal or objective.

Little To No Involvement

Refers to situations or contexts where individuals or groups contribute minimal effort or have minimal participation.

Achieving Goals

The process of setting objectives and taking steps to accomplish them within a specified timeframe.

Quarterly Estimated Tax Payments

Tax payments made quarterly by individuals and businesses on income not subject to withholding, including self-employment income.

Q5: Jenny, an individual cash basis taxpayer, has

Q14: Peter, proprietor of Peter's Easy Loan Company,

Q24: Sullivan, a pilot for Northern Airlines, has

Q47: Patricia contributes artwork to the art museum

Q53: Larry gives Linda 300 shares of stock

Q65: Drew incurs the following expenses in his

Q72: Drew Corporation purchased machinery costing $825,000 in

Q83: Which of the following individuals can be

Q106: On January 4, 2014, Owen died and

Q112: Karen is single and graduated from Marring