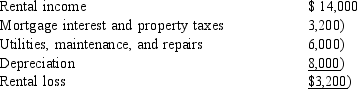

Landis is a single taxpayer with an adjusted gross income of $280,000. In addition to his personal residence, Landis owns a vacation home in Beaver Creek, Colorado. He uses the vacation home for 21 days during the current year and rents it out to unrelated parties for 63 days. After making the appropriate allocation between rental and personal use, the following rental loss is determined:  What is the correct reporting of the rental income and expenses? I. Because the rental shows a loss, Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction. II. Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses. III. Landis's depreciation deduction is limited to $4,800. IV. Because the vacation home is a qualified second residence, Landis can deduct the $1,600 loss for adjusted gross income.

What is the correct reporting of the rental income and expenses? I. Because the rental shows a loss, Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction. II. Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses. III. Landis's depreciation deduction is limited to $4,800. IV. Because the vacation home is a qualified second residence, Landis can deduct the $1,600 loss for adjusted gross income.

Definitions:

Immigrants

Individuals who move from one country to another with the intention of settling in the new country.

Poverty

A socio-economic condition characterized by the lack of financial resources to meet basic living needs, such as food, clothing, and housing.

Filial Maturity

A developmental stage where individuals attain an adult understanding and acceptance of their parents and parental figures, recognizing their strengths and weaknesses.

Expectancy

A belief or anticipation about the likelihood of an event occurring in the future.

Q7: A crucial question concerning income is when

Q8: Nora is the CEO of the publicly

Q12: Tax law generally disallows deductions for personal

Q44: Items that are excluded from gross income

Q48: Girardo owns a condominium in Key West.

Q49: Karl is an employee of Cars-R-Us. As

Q91: During the current year, Cathy realizes •

Q104: To qualify as a qualifying child, an

Q115: Alexis, a cash basis contractor, builds a

Q137: Alexis Corporation allows an employee, Cynthia, to