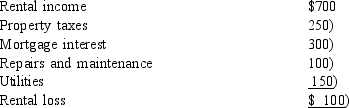

Mike and Pam own a cabin near Teluride, Colorado. In the current year the cabin was rented for 8 days to friends. Mike and Pam used the cabin a total of 82 days during the same year. After allocating the expenses between personal and rental use, the following rental loss was determined:  How should Mike and Pam report the rental income and expenses for last year?

How should Mike and Pam report the rental income and expenses for last year?

Definitions:

Barriers to Pride

Obstacles that prevent individuals or groups from feeling a sense of pride or satisfaction in their achievements.

14 Points

A framework for quality and performance improvement developed by W. Edwards Deming, aimed at transforming the effectiveness of a business.

Workout Process

A method or procedure designed to resolve business problems or improve operational efficiency through collaborative efforts.

High-performance Workplaces

Environments that enhance productivity and employee satisfaction through effective strategies and management practices.

Q5: Maria is on a "full ride" tennis

Q39: To be a qualifying relative, an individual

Q44: Richard pays his license plate fee for

Q51: Nora receives a salary of $55,000 during

Q58: Which of the following must be classified

Q60: Martha is single and graduated from Ivy

Q76: Tax planning involves the timing of income

Q112: Laurie's Lawn Service, Inc., purchases a heavy-duty

Q121: Hector's employer has a qualified pension plan

Q123: Mollie is single and is an employee