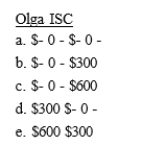

Olga is a technical sales consultant for Interactive Systems Corporation ISC) based in San Diego. While on business in Boise, she entertains several clients at a cost of $600. When she returns to San Diego, Olga gives ISC receipts and other information to account for the entertainment expense. ISC reimburses Olga $600. How much can Olga and ISC deduct?

Definitions:

Interaction Analysis

The study or examination of how individuals communicate and engage with each other within a specific context.

Nursing Diagnosis

A clinical judgment about individual, family, or community experiences/responses to actual or potential health problems/life processes.

Passive

The acceptance or submission to something without active response or resistance.

No Emotion

A state or condition where a person does not exhibit or feel any emotions.

Q10: Larry is a self-employed insurance salesperson. He

Q16: Harry owed $10,000 to his employer. The

Q22: Walker, an employee of Lakeview Corporation, drives

Q30: On June 1, 2014, AZ Construction Corporation

Q30: To qualify as a qualifying relative, an

Q35: Explain why the taxpayer in each of

Q58: All of the following are a required

Q86: Serena owns a van that she paid

Q106: Which of the following individuals or couples

Q121: Canfield is single, 70 years old, and