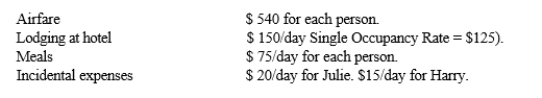

Julie travels to Mobile to meet with a client. While in Mobile, she spends 4 days meeting with the client and one-day sightseeing. Her husband Harry goes with her and spends all 5 days sightseeing and playing golf. The cost of the trip is as follows:  If Julie is self-employed, what is the amount of the deduction she may claim for the trip?

If Julie is self-employed, what is the amount of the deduction she may claim for the trip?

Definitions:

College Student

A college student is an individual engaged in post-secondary education at a college or university, typically pursuing a degree or certification.

Perfect Complements

Goods that are always used together in fixed proportions, where the utility of one item increases with the use of the other.

Indifference Curves

Graphical representations in economics showing different combinations of goods or services among which a consumer is indifferent, demonstrating preferences.

Optimal Choice

The best possible decision or selection made from a set of alternatives, given the constraints and objectives at hand.

Q3: John decides rather than work late in

Q17: Sarah owns a passive activity that has

Q20: Darnel owns 10% of the stock in

Q24: A limitation exists on the annual amount

Q29: An installment sale I. occurs whenever property

Q58: All of the following are a required

Q82: Which of the following items is not

Q90: Clarance rented office space to an attorney

Q90: Which of the following business expenses is/are

Q130: An ordinary expense I. is an expense