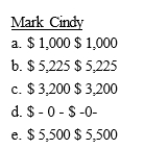

Mark and Cindy are married with salaries of $45,000 and $42,000, respectively. Adjusted gross income on their jointly filed tax return is $97,000. Both individuals are active participants in employer provided qualified pension plans. What is the maximum amount each person may deduct for AGI with regard to IRA contributions?

Definitions:

Employment Contract

A legally binding agreement between an employer and an employee that outlines the terms and conditions of employment.

Promissory Note

A financial instrument that contains a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date.

Signing Authority

The legal power granted to an individual or entity to sign official documents on behalf of another person or organization.

Breached Fiduciary Duty

A violation where a person in a position of trust fails to act in the best interests of another party they owe a duty to.

Q8: Sergio purchases $3,000-worth of supplies from a

Q12: Janelle receives a sterling silver tea set

Q53: The Wondercress Advertising agency rents a skybox

Q58: Daniel purchases 5-year class listed property a

Q76: Janet is the business manager for Greenville

Q78: To be deductible, employee compensation must be

Q85: Harry is a CPA employed as a

Q88: Milton is experiencing cash flow problems during

Q94: Kevin, single, is an employee of the

Q129: To be a qualifying relative, an individual