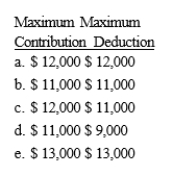

Carl, age 59, and Cindy, age 49, are married and file a joint return. During the current year, Carl had a salary of $41,000 and Cindy had a salary of $35,000. Both Carl and Cindy are covered by an employer-sponsored pension plan. Their adjusted gross income for the year is $94,000. Determine the maximum IRA contribution and deduction amounts.

Definitions:

Q19: Long-term capital gain classification is advantageous to

Q21: Which of the following factors absolutely must

Q43: Which of the following events is a

Q48: National Corporation allows an employee, Phyllis, to

Q57: Linc, age 25, is single and makes

Q63: Samantha incurs the following medical expenses for

Q65: In which of the following circumstances will

Q80: Olivia sells some stock she purchased several

Q99: Joline works as a sales manager for

Q105: Indicate which of the following statements is/are