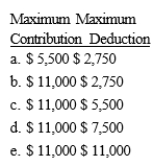

Fred and Irma are married with salaries of $49,000 and $44,000, respectively. Their combined AGI is $106,000. Both are active participant in their companies' qualified pension plans. Determine their maximum combined IRA contribution and deduction amounts?

Definitions:

Target Profit

The predetermined amount of profit a company aims to achieve within a certain period.

Dollar Sales

The total revenue or sales value of a product, service, or business transaction expressed in terms of dollars.

Target Profit

The amount of net income a company aims to achieve for a specific period as part of its financial and operational planning.

Fixed Expense

Costs that do not change with the level of goods or services produced by the business, such as rent or salaries.

Q20: Darnel owns 10% of the stock in

Q21: In 2014, Sanford Corporation purchases and places

Q27: Hank, whose adjusted gross income is $100,000,

Q48: Girardo owns a condominium in Key West.

Q56: Which of the following intangible assets is

Q73: Drew graduated from business school in December

Q104: Using the general tests for deductibility, explain

Q121: Which of the following tax rates applies

Q124: Charlie is single and operates his barber

Q130: Which of the following will prevent a