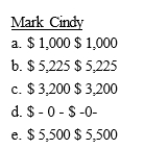

Mark and Cindy are married with salaries of $45,000 and $42,000, respectively. Adjusted gross income on their jointly filed tax return is $97,000. Both individuals are active participants in employer provided qualified pension plans. What is the maximum amount each person may deduct for AGI with regard to IRA contributions?

Definitions:

Prorated

The allocation or division of amounts or costs proportionally according to a specific rate, size, or timeframe.

WIP

An acronym for Work In Progress, which refers to the materials and products that are in the process of being manufactured but are not yet complete.

Underapplied Overhead

A situation where the estimated overhead expenses are lower than the actual costs incurred, creating a variance in financial reporting.

Overapplied Overhead

A situation where the amount of manufacturing overhead allocated to products exceeds the actual overhead costs incurred.

Q5: Oscar buys a 10% interest in Britanny

Q9: Eileen pays $14,000 of interest related to

Q27: Hank, whose adjusted gross income is $100,000,

Q36: Larry is a single parent with an

Q44: Aunt Bea sold some stock she purchased

Q48: To qualify as a head of household,

Q59: Karl has the following income loss) during

Q61: Francisco's employer establishes Health Savings Accounts HSA's)

Q71: Barry owns all of the stock of

Q108: During the current year, Paul came down