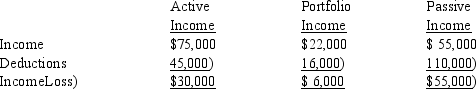

A taxpayer had the following for the current year:  I. If the taxpayer is a closely held corporation, taxable income from the three activities is income of $6,000. II. If the taxpayer is an individual and the passive income is not related to a rental real estate activity, taxable income is $36,000.

I. If the taxpayer is a closely held corporation, taxable income from the three activities is income of $6,000. II. If the taxpayer is an individual and the passive income is not related to a rental real estate activity, taxable income is $36,000.

Definitions:

Organizational Change

Change that a group of people must learn to accept and implement.

Technology Barrier

Obstacles that hinder the adoption, implementation, or effective use of technologies, possibly due to economic, social, or practical reasons.

OD Intervention

Training tools that teach members of the organization how to solve problems they face or make needed changes to organizational development (OD).

Companywide

Pertaining to or affecting all parts of a company, its employees, or its operations, usually in the context of initiatives, policies, or changes.

Q6: Determine the proper classifications) of a house

Q9: Jose, Mahlon, and Eric are partners in

Q29: Why would a taxpayer ever elect to

Q33: Judy and Larry are married and their

Q43: Which of the following events is a

Q57: Johnson Corporation's 2014 business operating income is

Q62: Moran pays the following expenses during the

Q72: Karl paid $200,000 for business-use equipment. Using

Q78: Morris is considering investing in some bonds.

Q129: Summary Problem: Tommy, a single taxpayer with