Multiple Choice

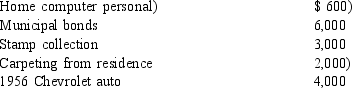

Samantha sells the following assets and realizes the following gains losses) during the current year:  As a result of these sales, Samantha's adjusted gross income will:

As a result of these sales, Samantha's adjusted gross income will:

Definitions:

Related Questions

Q15: Debra and Ken refinance their personal residence

Q17: Discuss whether the following expenditures meet the

Q22: An asset's holding period normally begins on

Q30: Barrett is a real estate broker. He

Q34: Harold purchases land and a building by

Q64: General Telelpnone gave Wynonna $2,000 for an

Q68: Which of the following expenses is/are deductible?

Q77: Kevin buys one share of Mink, Inc.,

Q83: Capital gain and loss planning strategies include

Q103: Kristine is the controller of Evans Company.