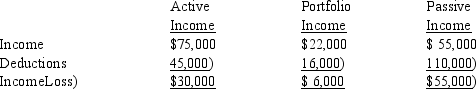

A taxpayer had the following for the current year:  I. If the taxpayer is a closely held corporation, taxable income from the three activities is income of $6,000. II. If the taxpayer is an individual and the passive income is not related to a rental real estate activity, taxable income is $36,000.

I. If the taxpayer is a closely held corporation, taxable income from the three activities is income of $6,000. II. If the taxpayer is an individual and the passive income is not related to a rental real estate activity, taxable income is $36,000.

Definitions:

Knowledge

Information, understanding, or skill that one gets from experience or education; the theoretical or practical understanding of a subject.

Jürgen Habermas

A German sociologist and philosopher known for his theory on the public sphere, discourse ethics, and the concept of communicative rationality.

Rationality

Primarily, the ability to think and to act according to goals, plans, and strategies. Rationality is also thinking well and effectively and having good, well-conceived goals, plans, and strategies. In the first instance, rationality is to be contrasted with nonrationality; in the second instance, it is contrasted with irrationality. Worms are nonrational; fools and fanatics are irrational.

Powerful

Pertaining to having great power, influence, or effect.

Q9: Sorensen Corporation purchases equipment in 2014 for

Q22: For its financial accounting records Addison Company

Q30: On June 1, 2014, AZ Construction Corporation

Q35: Art is supported entirely by his 3

Q49: Pedro sells a building for $170,000 in

Q51: To qualify for the child- and dependent-care

Q66: Which of the following is not deductible?<br>A)

Q66: Discuss the general differences between Section 1245

Q101: Section 1231 assets are certain trade or

Q122: Benjamin has the following capital gains and