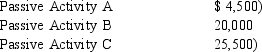

Linda owns three passive activities that had the following results for the current year:  If none of the passive activities are rental real estate activities, what is the amount of suspended loss attributable to Activity A?

If none of the passive activities are rental real estate activities, what is the amount of suspended loss attributable to Activity A?

Definitions:

Statement Of Cash Flows

A financial report that provides aggregate data regarding all cash inflows and outflows a company receives from its ongoing operations, investment, and financial activities.

Direct Method

A way of reporting cash flows from operating activities in a cash flow statement that lists specific types of cash receipts and payments.

Cash Inflow

Money coming into a business or project from various sources including sales, investment income, or financing.

Cash Outflow

Money that flows out of a business or a financial account, typically representing expenses or investments.

Q16: Harry owed $10,000 to his employer. The

Q17: Hector receives a gift of rare books

Q18: Michael operates an illegal cock fighting business.

Q21: The Big Easy Company leases a luxury

Q39: The Ottomans own a winter cabin in

Q64: General Telelpnone gave Wynonna $2,000 for an

Q73: Determine the proper classifications) of the asset

Q82: Kenzie and Ross equally own rental real

Q92: During the year, Shipra's apartment is burglarized

Q120: Gus owes $50,000 in credit card debt