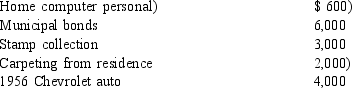

Samantha sells the following assets and realizes the following gains losses) during the current year:  As a result of these sales, Samantha's adjusted gross income will:

As a result of these sales, Samantha's adjusted gross income will:

Definitions:

Promise

A declaration or assurance that one will do a particular thing or that a particular thing will happen.

Gift

A voluntary transfer of property or funds from one person to another without expectation of receiving something in return.

Mislaid Property

Property that is intentionally placed somewhere but then forgotten by the owner.

Lost Property

Items that are unintentionally left by their owner at a specific location, which can then be found by others.

Q8: Which of the following exchanges of property

Q11: Ralph buys a new truck 5-year MACRS

Q17: Hector receives a gift of rare books

Q34: Stan sells a piece of land he

Q45: Kevin wants to know if he can

Q85: During 2013, Virginia, an architect, made a

Q90: In order to take a business deduction,

Q99: Mike purchases a computer 5-year property) for

Q101: The mid-year convention under MACRS provides that<br>A)

Q109: Which of the following is not a