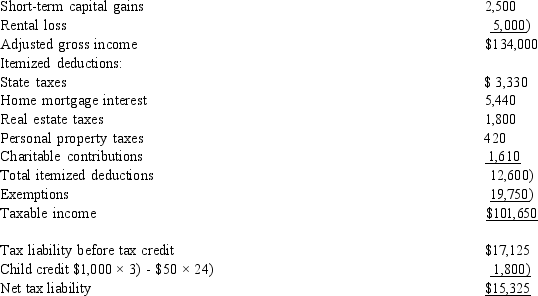

COMPREHENSIVE TAX CALCULATION PROBLEM. Girardo and Gloria are married with 3 children, ages 14, 11, and 8. Gloria is a senior vice-president for a security firm and Girardo is a househusband who spends 15 hours a week doing volunteer work for local organizations. Girardo inherited $800,000 from his grandfather in 1999. He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio. Prior to becoming a househusband, Girardo was an award winning high school accounting teacher. In February of 2014, Girardo is approached by the high school principal about returning to his former position. Girardo would receive an annual salary of $50,000. He is a little hesitant about accepting the offer, because he enjoys his volunteer work. Girardo's accountant has provided him with the following projection of their 2014 tax liability:  Gloria's salary $130,000 Interest income 6,500

Gloria's salary $130,000 Interest income 6,500  Girardo's projection from his accountant does not include his salary from teaching. Assume that Girardo's pro-rata salary for the year will be $30,000. Calculate Girardo and Gloria's tax liability, if Girardo decides to return to teaching. Also determine the marginal and effective tax rates on Girardo's salary.

Girardo's projection from his accountant does not include his salary from teaching. Assume that Girardo's pro-rata salary for the year will be $30,000. Calculate Girardo and Gloria's tax liability, if Girardo decides to return to teaching. Also determine the marginal and effective tax rates on Girardo's salary.

Definitions:

Aggressive Investment

An investment strategy characterized by seeking higher returns through taking on a greater level of risk, typically involving investments in volatile stocks, sectors, or markets.

Product Life Cycle

The series of stages a product goes through from introduction to the market, growth, maturity, and eventually decline.

Strategic Fit

The degree to which an organization’s strategies align with its external environment and internal resources and capabilities.

Implied Demand Uncertainty

The unpredictability associated with customer demand, influenced by various factors that a business must consider in planning.

Q2: Tisha's husband died in 2011. She has

Q31: Unreimbursed medical costs are deductible only to

Q35: Ford's automobile that he uses 100% for

Q35: Winston is the sole shareholder of Winston

Q56: Carlos is single and has a 7

Q68: Morris is a single individual who has

Q71: Snoopy Corporation, Garfield Corporation, and Dogbert Corporation

Q80: Cory and Leslie are married and have

Q86: Which of the following is true concerning

Q130: An ordinary expense I. is an expense