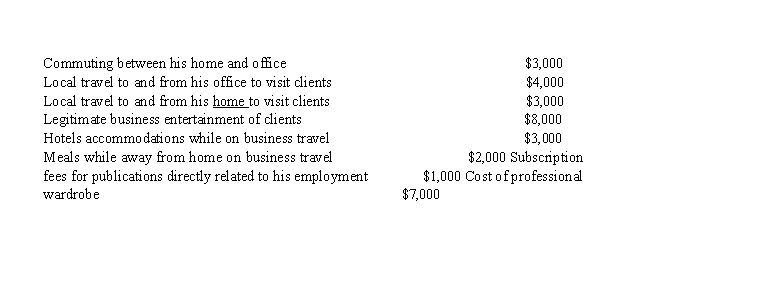

Julius is an employee of a large consulting firm. During the year he incurs the following expenses in his job, none of which are reimbursed by his employer. Julius's adjusted gross income is $100,000 before considering these expenses.  What is Julius's miscellaneous itemized deduction?

What is Julius's miscellaneous itemized deduction?

Definitions:

Formatted Screens

Refers to digital displays or interfaces that have been organized or structured in a specific way for ease of use and readability.

Patient Accounts

Refers to the financial records and management of a patient's charges, payments, and balances within a healthcare facility.

Vendors

Businesses or individuals that sell goods and services.

Double-Entry Bookkeeping System

An accounting system where every entry to an account requires a corresponding and opposite entry to a different account, ensuring the accounting equation remains balanced.

Q2: Which of the following payments are deductible?

Q4: Ona is a professional musician. She prepared

Q38: During the current year, Alyssa incurred a

Q54: Richard, a cash basis taxpayer, is an

Q61: Which of the following taxpayers can claim

Q62: Sarah gave her granddaughter, Alice, some Eli

Q88: John discovers that termites have destroyed the

Q105: Which of the following is are) correct

Q112: Cheryl purchased 500 shares of Qualified Small

Q124: Benton leases a Park City condominium from