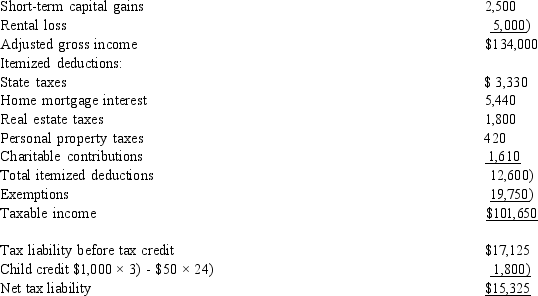

COMPREHENSIVE TAX CALCULATION PROBLEM. Girardo and Gloria are married with 3 children, ages 14, 11, and 8. Gloria is a senior vice-president for a security firm and Girardo is a househusband who spends 15 hours a week doing volunteer work for local organizations. Girardo inherited $800,000 from his grandfather in 1999. He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio. Prior to becoming a househusband, Girardo was an award winning high school accounting teacher. In February of 2014, Girardo is approached by the high school principal about returning to his former position. Girardo would receive an annual salary of $50,000. He is a little hesitant about accepting the offer, because he enjoys his volunteer work. Girardo's accountant has provided him with the following projection of their 2014 tax liability:  Gloria's salary $130,000 Interest income 6,500

Gloria's salary $130,000 Interest income 6,500  Girardo's projection from his accountant does not include his salary from teaching. Assume that Girardo's pro-rata salary for the year will be $30,000. Calculate Girardo and Gloria's tax liability, if Girardo decides to return to teaching. Also determine the marginal and effective tax rates on Girardo's salary.

Girardo's projection from his accountant does not include his salary from teaching. Assume that Girardo's pro-rata salary for the year will be $30,000. Calculate Girardo and Gloria's tax liability, if Girardo decides to return to teaching. Also determine the marginal and effective tax rates on Girardo's salary.

Definitions:

Reflection

The process of thoughtfully considering one's actions, feelings, or experiences, often used in learning or therapeutic contexts.

Summarization

The act of presenting the main points or essence of a larger body of information in a concise form.

Summarization

The process of concisely presenting the main points or essence of a text or speech.

Pace of Session

The speed or rhythm at which a therapy or counseling session progresses, often adjusted by the therapist to match the client's needs or comfort level.

Q5: Chase, Marty and Barry form a partnership.

Q12: Dustin buys 200 shares of Monroe Corporation

Q31: Ed and Elise got married during the

Q36: On July 17, 2014, Elise purchases office

Q54: Determine the proper classifications) of a house

Q55: Sophia, single, is a employee of JWH

Q79: For a taxpayer to be engaged in

Q88: Larry and Laureen own LL Legal Services

Q90: In order to take a business deduction,

Q104: Using the general tests for deductibility, explain