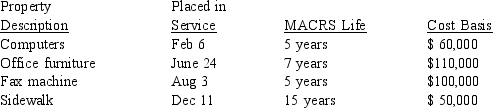

The Lovell Accounting Firm places the following new property in service during the 2014 tax year:  Lovell wants to obtain the maximum possible first year depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Lovell will report 2014 taxable income in the amount of $10,000 before consideration of depreciation on their 2014 property acquisitions. What is the maximum combined amount of depreciation and Section 179 expense that may be obtained under this set of fact circumstances?

Lovell wants to obtain the maximum possible first year depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Lovell will report 2014 taxable income in the amount of $10,000 before consideration of depreciation on their 2014 property acquisitions. What is the maximum combined amount of depreciation and Section 179 expense that may be obtained under this set of fact circumstances?

Definitions:

Conserve Water

The practice of using water efficiently to reduce unnecessary waste.

Public Commitments

Declarations or promises made by individuals or organizations in front of others, often to be held accountable for achieving certain goals or adhering to specific values or courses of action.

Creditors

Individuals or entities that lend money or extend credit to others, expecting repayment in the future along with any agreed-upon interest or fees.

Owners

Individuals or entities that have legal possession and control over a business or property.

Q13: Savings incentive match plan for employees SIMPLE)

Q14: Peter, proprietor of Peter's Easy Loan Company,

Q19: Roger owns 25% of Silver Trucking, a

Q32: Commonalties of nonrecognition transactions include that I.

Q32: MACRS eliminates several sources of potential conflict

Q38: Carlos incurs the following medical expenses during

Q40: Western Corporation began operations in 1999. Its

Q71: Homer and Marge are married and have

Q75: Nancy purchased her houseboat six years ago

Q75: When a security is sold at a