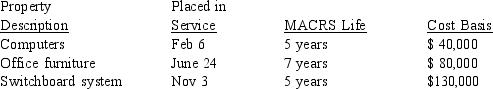

The Ross CPA Firm places the following property in service during the 2014 tax year:  Ross wants to obtain the maximum possible depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Ross will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is Ross' maximum depreciation from these additions?

Ross wants to obtain the maximum possible depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Ross will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is Ross' maximum depreciation from these additions?

Definitions:

Debit Card

A payment card that deducts money directly from a consumer’s checking account to pay for a purchase.

Credit Card

A plastic card issued by financial institutions that allows individuals to borrow funds at the point of sale, subject to repayment terms.

Bookmark Feature

A function that allows users to save and store links to specific web pages or locations for easy access later.

Web Page

A document accessible on the internet, formatted in HTML and viewable through a web browser.

Q10: The Section 179 election promotes which of

Q14: Harrison Corporation sells a building for $330,000

Q19: The general mechanism used to defer gains

Q25: Lynn is a sales representative for Textbook

Q28: Determine the proper classifications) of the asset

Q37: Which of the following legal expenses paid

Q40: Rosilyn trades her old business-use car with

Q68: For moving expenses to be deductible the

Q74: Eric, who is 18 years old, sells

Q105: Which of the following is are) correct