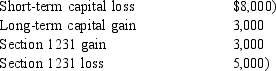

Gabrielle has the following gains and losses for the current year:  What is Gabrielle's net capital gain or loss position for the year?

What is Gabrielle's net capital gain or loss position for the year?

A) $7,000 net short-term capital loss.

B) $3,000 net short-term capital gain.

C) $5,000 net short-term capital loss.

D) $3,000 net short-term capital gain.

Definitions:

Traditional Costing

An accounting method that applies indirect costs to products based on a predetermined overhead rate.

Activity-Based Costing

An accounting method that assigns costs to products or services based on the activities they require, aiming for more accurate costing.

Overhead Rate

A calculation used to allocate overhead costs to produced goods or services, typically based on a specific activity base such as labor hours or machine hours.

Predetermined Overhead Rate

A rate calculated at the beginning of the period by dividing estimated total overhead costs by an estimated allocation base, used to apply overhead costs to products or services.

Q14: Harrison Corporation sells a building for $330,000

Q16: Maria, an engineer, has adjusted gross income

Q37: Carolyn purchases a new delivery truck 5-year

Q44: Ramona recognizes a $50,000 Section 1231 loss,

Q54: If an individual sells depreciable real estate

Q57: The Polaris S Corporation has operating income

Q57: One of the benefits of an incentive

Q63: Byron is a partner in the Dowdy

Q94: Salvador owns a passive activity that has

Q117: Victor bought 100 shares of stock of