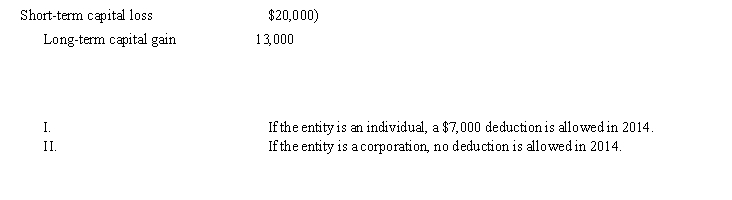

A taxable entity has the following capital gains and losses in 2014:

Definitions:

Gross Investment In Leased Asset

The total initial cost of an asset that is acquired for leasing out to others, including both the cash price and any additional expenses.

Leased Equipment

Assets that are rented under a contract for a specified period of time, often with terms that specify usage rights and requirements.

GAAP

A collection of commonly followed accounting rules and standards for financial reporting, used primarily in the United States.

Expense Recognition

Expense Recognition is an accounting principle that dictates the specific conditions under which expenses are recognized and reported in financial statements.

Q8: Which of the following exchanges of property

Q28: Dunn Company bought an old building in

Q41: Roscoe is a religion professor. During the

Q44: Curtis is 31 years old, single, self-employed,

Q44: Ramona recognizes a $50,000 Section 1231 loss,

Q45: Which of the following qualifies as a

Q46: Why did Congress enact the at-risk rules?

Q68: Rosie inherits 1,000 shares of Northern Skies

Q113: Benson Company purchased a drill press on

Q119: Ariel has two children, Christopher and Pat.