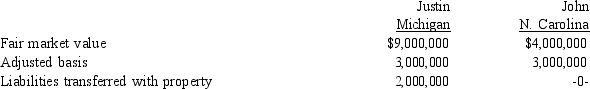

Justin trades an office building located in Michigan to John for an apartment complex located in North Carolina. Details of the two properties:

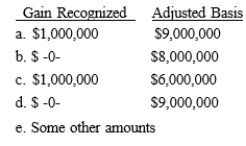

In addition, John pays Justin $3,000,000 cash as part of this transaction. What is the gain loss) recognized by John in this transaction and what is his basis in the Michigan property?

In addition, John pays Justin $3,000,000 cash as part of this transaction. What is the gain loss) recognized by John in this transaction and what is his basis in the Michigan property?

Definitions:

Self-Disclosure

The act of revealing personal information about oneself to others, which can foster intimacy, trust, and stronger interpersonal relationships.

Senses

The physiological capacities of organisms that provide data for perception, including sight, sound, taste, touch, and smell.

Sexual Satisfaction

The state or feeling of fulfillment and pleasure attained from sexual activities.

Power Equally

Power Equally emphasizes the balanced distribution of control, influence, and authority among all members within a group or society.

Q20: On June 10, 2013, Wilhelm receives a

Q26: Peter opened his IRA in 2003 and

Q31: Unreimbursed medical costs are deductible only to

Q34: The following data were analyzed using

Q45: The shareholder of an S corporation can

Q54: Once a corporation is formed, an exchange

Q59: A two-tailed test is conducted at the

Q64: Which of the following can be income

Q94: Philip has been working in Spain for

Q109: Frank's wife died in 2012. He has