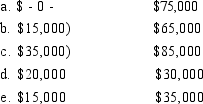

Matthew exchanges an investment apartment building for a parcel of land. The apartment building has a fair market value of $80,000 and an adjusted basis of $95,000. The land's value is $60,000. Matthew receives $20,000 cash in the exchange. What is Matthew's recognized gain or loss) on the exchange and his basis in the land? Gain Loss) Recognized Basis

Definitions:

Feelings of Safety at Night

An individual's perceived sense of security and well-being in public or private settings during nighttime.

Regression Equation

A mathematical formula used to predict a dependent variable based on one or more independent variables, typically in the form of Y = a + bX.

Gender

A range of characteristics pertaining to, and differentiating between, masculinity and femininity.

Y-Intercept

The location on a graph where a line or curve crosses the y-axis.

Q23: Which of the following qualify as replacement

Q41: Under a qualified pension plan I. The

Q41: Susan and Kyle are married and have

Q43: Sophia purchases a completely furnished condominium in

Q54: Of the 6796 students in one school

Q64: Discuss two tax-planning techniques that can be

Q66: Boston Company, an electing S corporation, has

Q67: Discuss why listed property gets special attention.

Q68: A corporation may reduce trade or business

Q79: Unrecaptured Section 1250 gain is taxed at