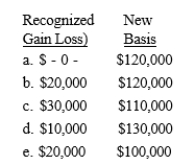

Daisy's warehouse is destroyed by a tornado. The warehouse has an adjusted basis of $130,000 when destroyed. Daisy receives an insurance reimbursement check for $150,000 and immediately reinvests $120,000 of the proceeds in a new warehouse. What are Daisy's recognized gain or loss) and her basis in the replacement warehouse?

Definitions:

Commerce Clause

A provision in the U.S. Constitution granting Congress the power to regulate trade between states and with foreign nations.

Interstate Commerce

Commercial transactions or movement of goods and services across state borders, regulated by federal law in the United States.

Judicial Review

The power of courts to assess the constitutionality of laws or government actions.

First Amendment

An amendment to the United States Constitution that protects freedoms concerning religion, expression, assembly, and the right to petition.

Q9: Sorensen Corporation purchases equipment in 2014 for

Q16: Tien purchases an office building for $400,000,

Q19: Long-term capital gain classification is advantageous to

Q29: Dorchester purchased investment realty in 1991 for

Q37: Which of the following properties that was

Q45: Joline operates Adventure Tours as a sole

Q53: Gomer is admitted to the Mouton Partnership

Q64: Which of the following is/ are appellate

Q78: Limited liability refers to an owner's liability

Q122: Which of the following taxes is deductible