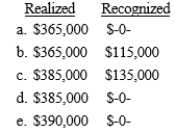

Tony and Faith sell their home for $495,000, incurring selling expenses of $25,000. They purchased the residence for $85,000 and made capital improvements totaling $20,000 during the 20 years they lived there. What is their realized gain and recognized gain on the sale?

Definitions:

Ronald Reagan

The 40th President of the United States, serving from 1981 to 1989, known for his conservative policies and role in ending the Cold War.

Political Orientation

A person or group's predetermined political stance or ideology, encompassing a range of views from conservative to liberal.

Democratic

Pertains to a form of government in which power is vested in the hands of the people, either directly or through elected representatives.

Q13: Valerie receives a painting as a gift

Q15: In general, qualified replacement property for an

Q18: During 2014, Duncan Company purchases and places

Q24: Ed's adjusted basis in his partnership interest

Q26: Tax characteristics of corporations include which of

Q36: A 95% confidence interval for the mean

Q48: If the total amount paid for a

Q76: Carlos is the contoller for Rooney Corporation.

Q99: Mike purchases a computer 5-year property) for

Q100: Net collectibles gains are taxed at a