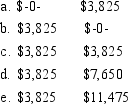

Foster owns 27% of the Baxter Corporation, whose ordinary income is $100,000. His salary for the year is $50,000. What amount must Foster pay in Social Security taxes if Baxter is an) Corporation S Corporation

Definitions:

Share of Income

This refers to an individual's or entity's portion of income earned by a business or investment, typically expressed as a percentage of total profits.

Capital Totaling

The sum of an entity's financial resources, including equity, debt, and other financial instruments, used to fund its operations and investments.

Distribution

The process of delivering products or services from the producer to the intended users.

Bonus

Additional compensation given to employees as a reward for their performance, often beyond their regular earnings.

Q17: A 95% confidence interval for the mean

Q18: In a national poll, 1036 people were

Q19: A two-tailed test is conducted at the

Q27: A random sample of 30 long

Q34: Nontax characteristics that should be considered in

Q66: Sergio is a 15% partner in the

Q71: Grant exchanges an old pizza oven from

Q82: Which of the following best describes the

Q113: Benson Company purchased a drill press on

Q116: George purchased a commercial building in 1994