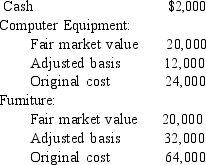

During 2014, Jimmy incorporates his data processing business. Jimmy is the sole shareholder. The following assets are transferred to the corporation:  How much gain loss) will Jimmy recognize from the transfer of the assets to the corporation?

How much gain loss) will Jimmy recognize from the transfer of the assets to the corporation?

Definitions:

Advance Directives

Legal documents that allow individuals to outline their preferences for medical care if they become unable to make decisions for themselves in the future.

Medical Directives

Legal documents that specify a person's wishes regarding medical treatment in circumstances where they are unable to make decisions.

Legal Instruments

Official legal documents like contracts, wills, or deeds that define rights, duties, entitlements, or liabilities.

Uniform Anatomical Gifts Act

A set of laws designed to regulate the donation of organs and tissues for medical use.

Q13: No taxable gain or loss is recognized

Q16: Brent purchases a new warehouse building on

Q30: Among a sample of 78 students selected

Q30: If you flip a coin three times,

Q43: Which of the following Letter Rulings might

Q47: Which of the following is/are correct concerning

Q54: Although nontaxable income and nondeductible expenditures are

Q57: The following table is from the

Q61: Lynne is a 15% partner with Webb

Q78: Rachael purchased 500 shares of Qualified Small