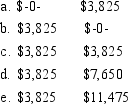

Foster owns 27% of the Baxter Corporation, whose ordinary income is $100,000. His salary for the year is $50,000. What amount must Foster pay in Social Security taxes if Baxter is an) Corporation S Corporation

Definitions:

Work in Process Inventory

Work in process inventory consists of goods partially completed, not yet ready for sale, representing the cost of raw materials, labor, and overhead involved in production.

Direct Materials

Raw materials that can be directly attributed to the production of goods.

Direct Labor

The wages and related expenses for employees who are directly involved in the production of goods or services.

Overhead Cost

Rephrased: Expenditures related to the business's general operations, not directly linked to any specific product or service.

Q9: A researcher wants to estimate the mean

Q28: The analysis of the data in Problem

Q36: A 95% confidence interval for the mean

Q39: Section 1231 assets include<br>A) Inventory.<br>B) Stocks and

Q40: Brad, an engineering consultant, was given stock

Q66: Dwayne is upset by an IRS agent's

Q67: Violet exchanges investment real estate with Russell.

Q72: Dana purchases an automobile for personal use

Q81: Sales of property between a partner who

Q90: Carlotta is the director of golf for