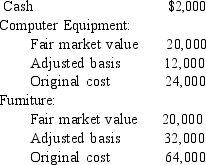

During 2014, Jimmy incorporates his data processing business. Jimmy is the sole shareholder. The following assets are transferred to the corporation:  How much gain loss) will Jimmy recognize from the transfer of the assets to the corporation?

How much gain loss) will Jimmy recognize from the transfer of the assets to the corporation?

Definitions:

Optimistic

Exhibiting a positive and hopeful outlook towards future outcomes, expecting the best possible results in any scenario.

Straight Rebuys

Routine purchases of the same products without seeking new information or considering other suppliers.

Caretaker Rep.

The representation or responsibilities of an individual or entity acting in a caretaking role, particularly in maintaining or overseeing property or individuals.

Straight Commission

A compensation method where an employee's income is derived entirely from a percentage of the sales they make, without a base salary.

Q6: Which of the following qualifies as a

Q25: Concerning the credit for child and dependent

Q31: Why might a taxpayer elect to depreciate

Q41: The t distribution can be used when

Q62: Rolling a 4 with a fair die<br>A)

Q65: Which of the following intangible assets is

Q73: Benito owns an office building he purchased

Q76: A taxpayer must begin withdrawals from any

Q88: Arturo is a 15% partner in the

Q98: To obtain the rehabilitation expenditures tax credit