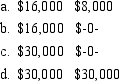

Global Corporation distributes property with a basis of $22,000 and a fair market value of $30,000 to Arturo in complete liquidation of the corporation. Arturo's basis in the stock is $14,000. What must Arturo and Global report as income upon the liquidation of Global? Arturo Global

Definitions:

Least of the Evils

A principle involved in decision making that opts for the less harmful or least undesirable option among several bad choices.

Process Philosophy

A philosophical approach that emphasizes becoming, change, and the dynamic nature of reality over static being or existence.

Creating Himself

The philosophical concept of an individual actively shaping their own identity, character, and essence through their choices and actions.

Creationists

Individuals or groups who support creationism, the religious belief that the universe and life originated from specific acts of divine creation.

Q7: An internet sales company decided to charge

Q8: The mid-quarter convention I. never applies to

Q12: The students in Hugh Logan's math

Q25: A consumer group claims that the

Q27: Bronco Corporation realizes $270,000 from sales during

Q29: Why would a taxpayer ever elect to

Q30: Title 26 of the U.S. Code includes<br>A)

Q70: Which of the following will render a

Q81: Lindale Rentals places an apartment building in

Q84: Explain why a taxpayer would ever consider