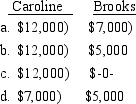

Brooks Corporation distributes property with a basis of $20,000 and a fair market value of $25,000 to Caroline in complete liquidation of the corporation. Caroline's basis in the stock is $32,000. What must Caroline and Brooks report as income loss) upon the liquidation of Brooks?

Definitions:

Rahim

Refers to M. Afzalur Rahim's work on organizational conflict and conflict management strategies, emphasizing a systematic approach.

Conflict Styles

Distinct approaches to addressing and managing conflict, including strategies such as avoidance, competition, accommodation, compromise, and collaboration.

Avoidance

The action of keeping away from or not engaging in something, particularly in regards to situations or interactions perceived as negative or harmful.

Conflict Style

The approach or technique an individual uses to handle disagreements, disputes, or differences with others.

Q8: Partnership debts assumed by a partner is

Q8: Is it "significant" to get an 11

Q11: Gains on the sale of certain types

Q17: A 95% confidence interval for the mean

Q18: During 2014, Duncan Company purchases and places

Q26: A manufacturer claims that the mean

Q26: There are over 1200 species of inchworms

Q38: Select the distribution that appears to be

Q57: The mid-year convention is used for personal

Q60: If more than 40% of the depreciable